It’s not often the secretary of the U.S. Department of the Interior visits Wisconsin and other states to personally deliver nearly millions in grant money for conservation programs, but that’s just what happen when Secretay Zinke came to town. Rarer yet is when almost everyone witnessing the transactions takes pride in having generated that funding through self-imposed taxes. In fact, they even trust their fish and wildlife agencies to invest those millions wisely into fish and wildlife projects across their states.

Politicians and other demagogues take note: When you treat voters like adults, taking time to explain how specific taxes are assessed, and explaining how those revenues circle back to benefit those paying them, folks proudly pay. After all, the benefits include scientific research, habitat projects, access trails, boat ramps, hunter education, fish-cleaning stations and fish-stocking efforts, to name a few.

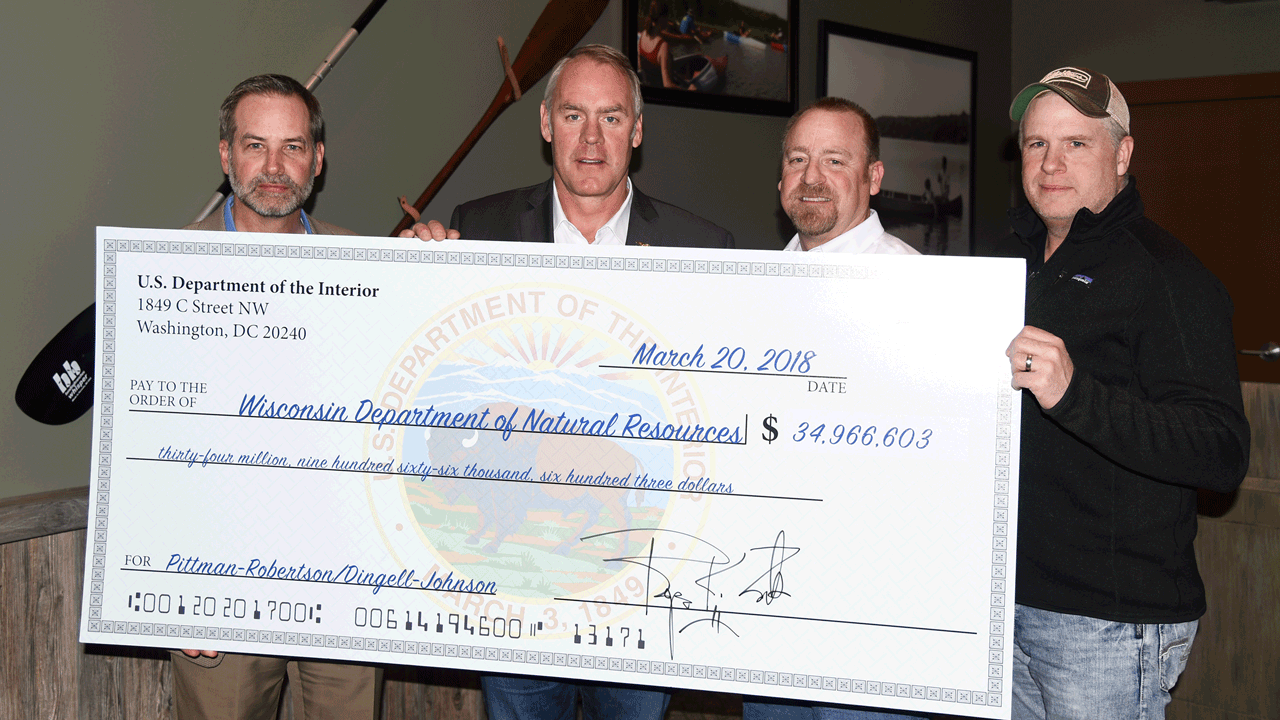

That was the situation in late March when Interior Secretary Ryan Zinke showed up at the Horicon Marsh State Wildlife Area with a whopper check made out to the Wisconsin Department of Natural Resources for $34,966,603.

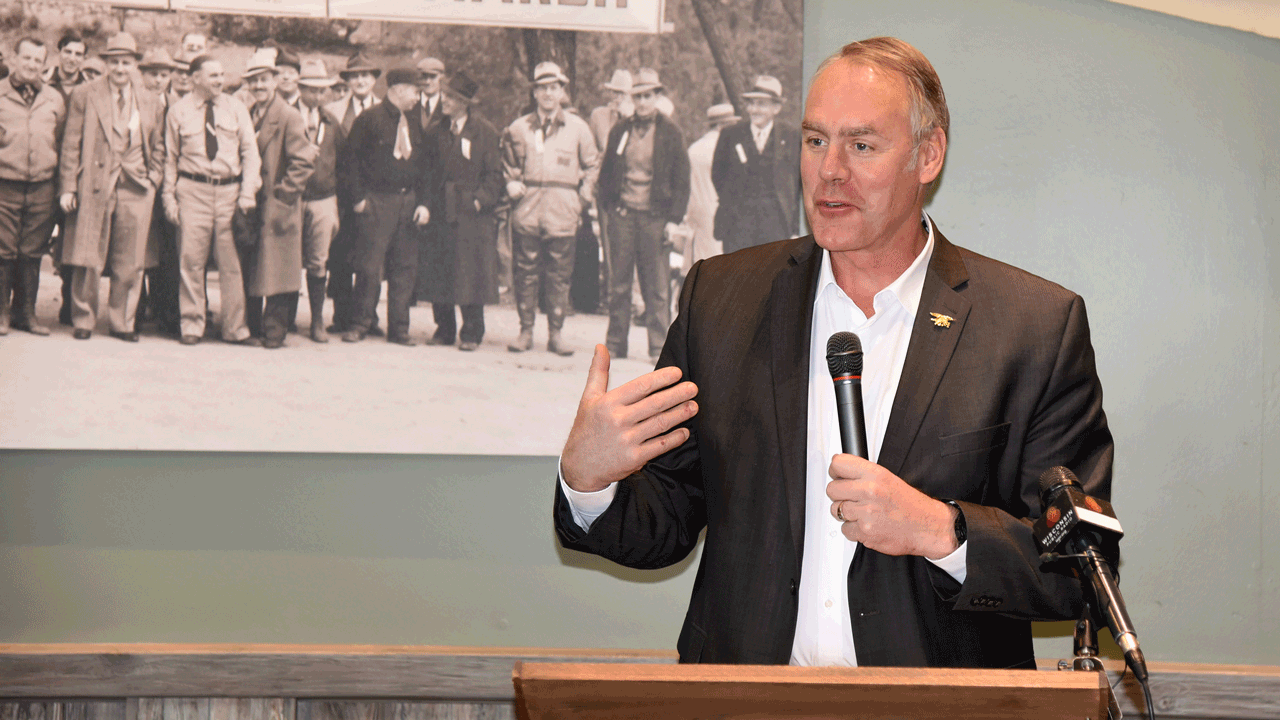

Interior Department Secretary Ryan Zinke spoke recently at the Horicon Marsh State Wildlife Area when presenting nearly $35 million in grants to the Wisconsin Department of Natural Resources.

Zinke visited several states in March to hand-deliver the payouts, which total $1.1 billion nationwide for 2018. Wisconsin ranks No. 6 nationally – historically and usually annually – behind Texas, Alaska, Pennsylvania, Michigan and California in grant receipts from the U.S. Fish and Wildlife Service, one of many agencies Zinke oversees.

The grants come from two sources of federal excise taxes: The Pittman-Robertson Wildlife Restoration Fund, and the Dingell-Johnson Sportfish Restoration Fund.

Combined, those contributions represent about 25 to 30 percent of many agencies’ annual fish and wildlife budgets. The rest comes mainly from fishing and hunting licenses and stamps.

To receive those payouts, states must match 25 percent of the annual federal grants.

OK. Show of hands: Who knows who pays the taxes for all those federal grants? Hint: It’s not general taxpayers.

Don’t feel bad if your hand isn’t up. Most who ultimately pay the FET don’t know either. In fact, most people working for companies that write the actual tax checks to the IRS have no idea how much their employer pays, annually or historically.

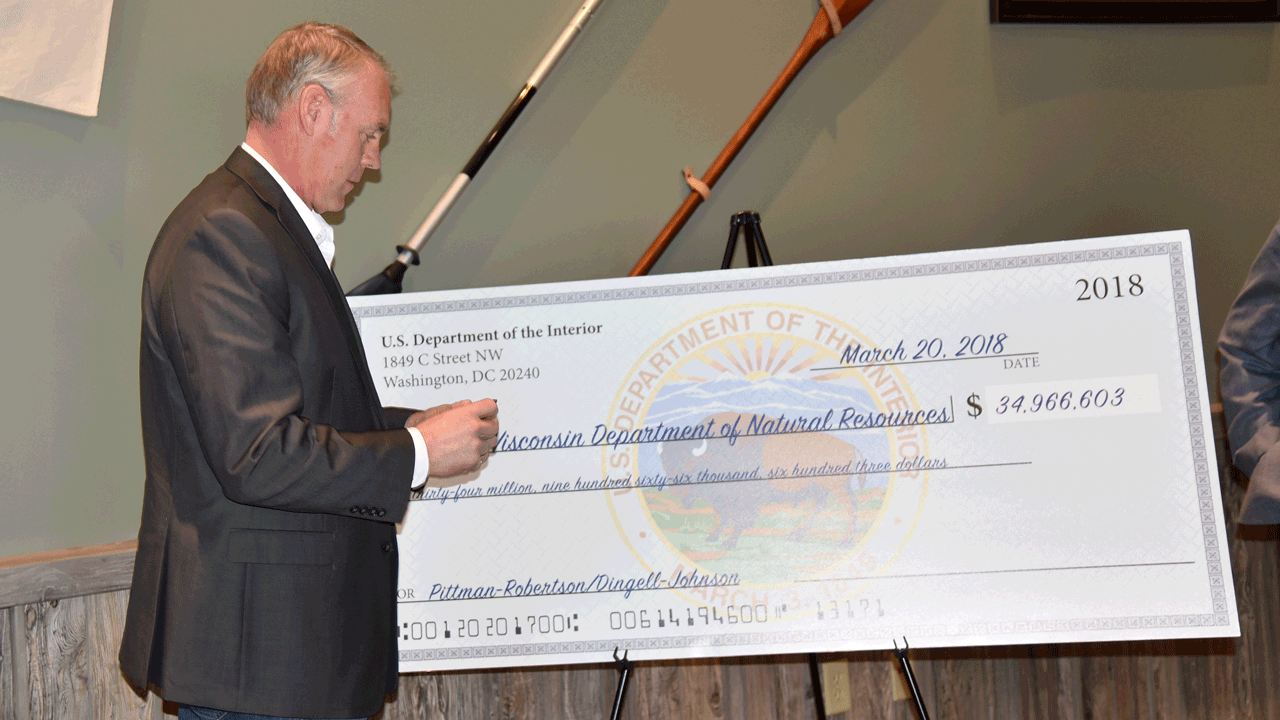

Interior Department Secretary Ryan Zinke prepares to sign a ceremonial check payable to the Wisconsin Department of Natural Resources.

When Secretary Zinke addressed the Horicon crowd of roughly 100 people in March, he probably could have embarrassed a third of the room by quizzing them about these vital fish and wildlife programs. And these folks weren’t slouches. Among them were many top conservationists, elected officials, news gatherers, outdoor-industry professionals, and state and federal workers.

The group’s smart alecks, however, know Pittman-Robertson imposes an 11 percent tax on each rifle, shotgun and box of ammunition sold, and 10 percent on each handgun and box of ammo sold. It also imposes an 11 percent tax on most bows, arrow points and bow-mounted accessories, and a variable tax on each arrow shaft sold. Since P-R’s passage, its FETs have contributed about $10.7 billion for conservation nationwide.

The Dingell-Johnson Act imposes federal taxes on fishing tackle such as rods, reels, line, lures, hooks, sinkers, electric motors, and motorboat fuels; and import duties on boats, sailboats and yachts. Since D-J’s passage, its FETs have contributed about $8.3 billion for conservation nationwide.

Manufacturers of all those hunting, fishing and boating products pay those taxes to the IRS, and presumably pass along much of the cost to their customers. The IRS transfers the revenue to the U.S. Fish and Wildlife Service, which then distributes it to states in proportion to their land size and hunting/fishing license sales. That’s why Texas, Alaska and Pennsylvania receive the most wildlife funding annually; and Texas, Alaska and California receive the most sportfish funding.

In other words, most of the United States’ fish and wildlife programs – including access to most of our public lands – have been funded for decades by hunters and anglers. All of them know what they contribute when buying duck stamps, trout stamps, deer licenses or nonresident elk tags. The prices are on the receipts.

Few, if any, know how much they pay indirectly in FET each year. They can’t know unless they keep every gear receipt and calculate the percentage on each sale.

The bigger mystery is why few, if any, employees of hunting, fishing, shooting and boating manufacturers know how much FET their employers pay. We understand why companies don’t want to publicize annual payouts, but you’d think every company’s website and catalog would proudly share its historical P-R or D-J contributions. If they and their employees proudly touted their investments in the public’s fish and wildlife, their customers would proudly share that important conservation news with friends, neighbors and coworkers.

Interior Department Secretary Ryan Zinke, second from left, poses behind a ceremonial check with three representatives of the archery/bowhunting industry. From left, Kurt Bassuener, president of MWS Associates of Sturgeon Bay; Zinke; Jeff Adee, president/owner of Headhunter Bowstrings; and Joel Maxfield, brand manager for Mathews Inc.

Bowhuters can’t take these contributions for granted. After all, that funding is slowly declining as hunter and angler numbers slide nationwide. Who will make up for those revenue losses?

During a “media gaggle” after his Wisconsin speech, Zinke said the Interior Department is committed to working with the private sector to improve access to public lands, and replace “atrophied programs” that aren’t doing enough to sustain hunter and angler numbers.

“We’re looking at public-private partnerships to bring a lot of those programs back, and to get kids out there and introduce them to the legacy given to us,” Zinke said. “Last year we were very energy-centric in relighting the pilot light on American energy; made-in-America energy. Now it’s time to do a pivot and look at rebuilding our (national) park system, rebuilding our wildlife refuges … reorganizing (the Interior Department) on the basis of science, and being better stewards for the future by accounting for (entire) watersheds and wildlife corridors.”

Efforts like that, however, are likely beyond the declining capacity of the nation’s hunting and fishing communities.

Something tells me we already need a third federal excise-tax-system to meet that commitment. Maybe it’s time other outdoor and “watchable wildlife” recreationists and their industries shoulder their share for conservation.

By

By